Your most important job as an in-house operator is to make wise choices about the work you do.

Unfortunately, it’s all too easy to hustle and grind through a quarter without getting the impact you hoped for.

There will always be far too many projects competing for some of your strategic, discretionary time.

So, how do you choose the right work?

Beware of the backlog

Most operators have a backlog of potential work. These ideas can be generated by the RevOps team or requests from client departments.

When it’s time to plan your next month / quarter / sprint, you try to groom the backlog and prioritize it in some way to select the work you’re going to do.

Don’t get me wrong: a backlog is useful and necessary. But if you rely solely on a backlog to define your work, it can create blindspots.

In episode #5 of RevOps FM, Jen Igartua (CEO of Go Nimbly), talks about the risks of letting a backlog drive your priorities:

You already have a backlog somewhere, right? You've got a bunch of requests that have come in. You have a bunch of problems you've found….And typically when a team says, “Hey, we need a roadmap” or “we need to plan for next quarter,” they'll pull up that list. […]

And then we'll give it some sort of framework [for prioritization]. Maybe we'll do the urgent versus important framework, or we'll do impact versus effort, and we'll figure out what we need to work on. […]

The problem with that is it's starting with ideas and features and work, and it's not talking about the gap or the problem or the inflection point that we're going after.

Backlogs can be dangerous because they aren’t comprehensive. Even if you apply a rigorous prioritization methodology to your backlog, you’re still starting from a limited set of potential ideas.

What if the highest-impact activities didn’t make it into your backlog in the first place?

Practical example:

As a home owner, you keep a backlog of work you want to do around the house.

You've just prioritized your house projects for the year, and the highest-priority item by far is to put on a new roof. Roof leaks can be very damaging, so this seems like a sensible priority.

You get to work on your new roof, but meanwhile there's a fire in the basement you didn't know about that threatens the entire structure...Of course, no one’s going to make this mistake in real life.

But in business, it can happen easily! The fires can be invisible if you don’t look at the data.

It's not uncommon for operators to focus on projects that are useful in themselves (the roof) while disregarding significant, revenue-impacting issues in the funnel (the fire) due to lack of situational awareness.

If this happens, it’s a sign that you aren't close enough to your KPIs.

Starting with the business

To avoid these blindspots, you need a way to look at the business holistically and identify where your effort can have the most impact.

Instead of basing your priorities solely on the backlog (which may be non-comprehensive) consider the performance of the business against its key objectives. By identifying the gaps in that performance, you can determine where to direct your effort.

Jen uses the term “gap-first thinking” to describe this process:

…start with [the question] “What's the outcome?” Are we doubling our sales team by next quarter? Are we going to IPO? Do we have new products launching? […] Then what's getting in our way of that work? That needs to be prioritized first.

Having that clarity gives you an ability to look at something and be like, “well, that's not important. I'm not going to do that work.”

And without it, you end up prioritizing things that you are speculating will have impact.

Now, take a look at this quote from Ben Marchal, COO of 360Learning, in episode #8. He describes a nearly identical process:

I [started to look at] what are the main KPIs…that are actually driving performance.

And once I had that, I had…a very clear picture of where we should focus our efforts.

So I can have the discussion with the VP or the C-level and say, your managers are asking me to do X, Y, Z, but looking at this picture… don't think this is the main issue of the team. I think actually the main issue is there and and this is what we should do.

And you know, switching that, having that conversation then with the VP or the C-Level changes completely the dynamic in in the work. Now you become a strategic partner for them.

Let’s examine the common elements between how both operators approach prioritization:

The starting point for prioritization is to look at business goals

Next you evaluate the most significant gaps or opportunities related to those goals using objective data, like KPIs

With that understanding, you can push back against lower-value work and build consensus around the work that will be most impactful.

Using KPIs to identify the most important gaps

Even with a gap-first mindset in place, it’s not always easy to identify where the most important gaps are.

You need to be data driven. But I find you also need a healthy dose of common sense, as otherwise you can spend all your time planning and succumb to analysis paralysis.

KPIs are the most logical place to start. Jen recommends using “3VC” (Volume, Value, Velocity, and Conversion) as a set of KPIs that can be applied to any stage of the funnel.

By examining these KPIs for different funnel stages, you can drill down into where your gaps might be and also evaluate different points of leverage for closing those gaps.

Practical example:

Your marketing team is behind on its pipeline goal this quarter. They could impact this metric in a variety of ways:

Volume: produce more leads, leading to more opportunities

Value: generate leads that become bigger opportunities (higher amount)

Velocity: generate leads that convert more quickly

Conversion: convert a higher percentage of leads to opportunitiesBen similarly focuses on KPIs to identify gaps, but he recommends building a “KPI tree” for each part of the business.

I like this approach as it allows you to get very granular and uncover factors that might be hidden from view or masked by over-performance in other areas.

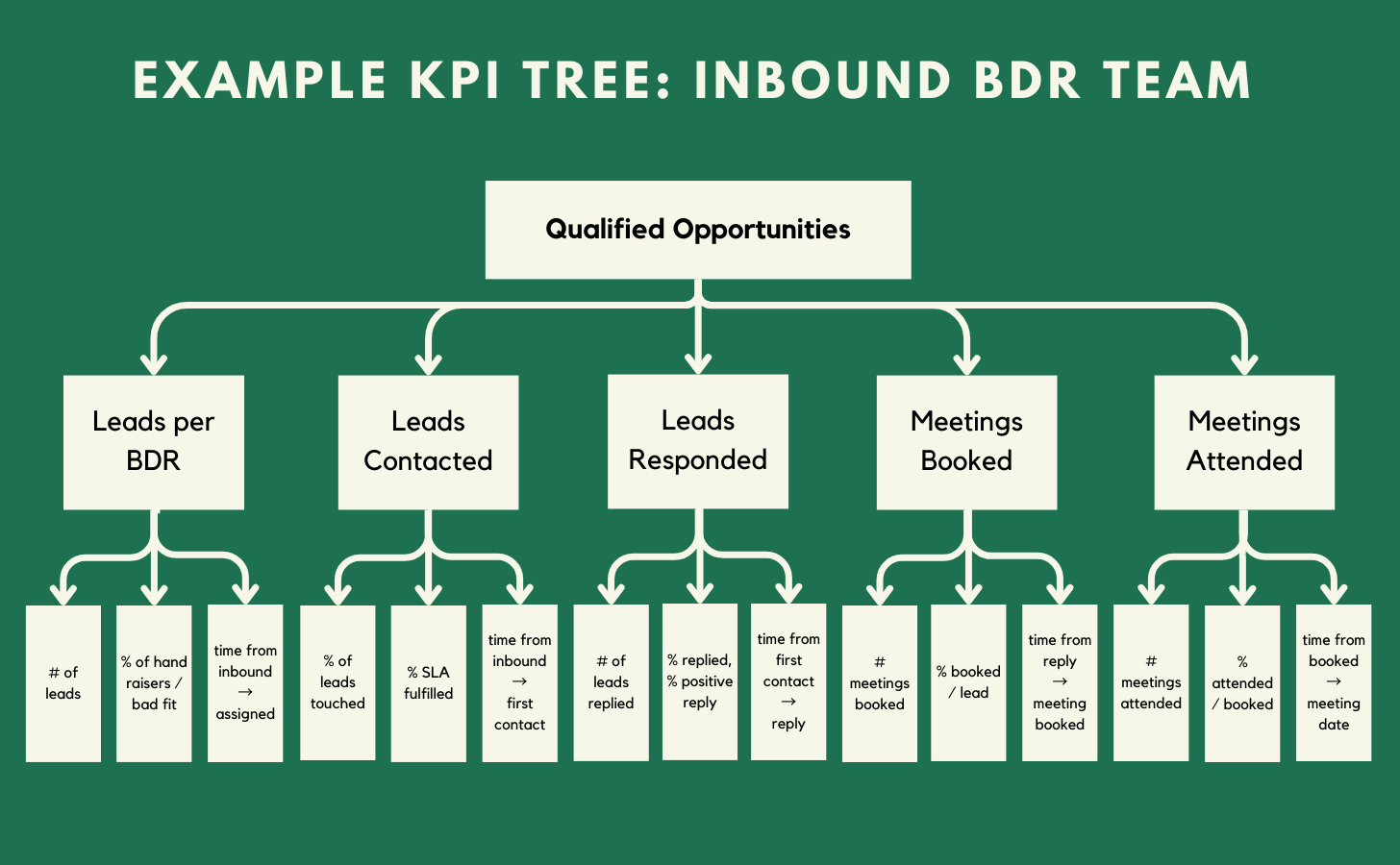

Example KPI tree for an inbound BDR team

Here’s a practical example of a KPI tree for an inbound BDR team. These are the real KPIs we use at my company for BDR Operations (which is part of my team’s scope).

You can see that many of the metrics are one of the 3VC KPIs that Jen describes.

But some of them are arguably slightly different—for example, quality-related KPIs like the % of leads that are higher intent or that are not a fit.

We might also include additional tangential metrics like

cadence engagement metrics (a proxy for the effectiveness of our sales outreach)

BDR employee satisfaction surveys (a proxy for morale / motivation of the team)

individual rep target achievement (as high performers can balance out low performers in aggregate)

and so on

I also like that the KPI tree reveals the hierarchical relationship between KPIs, allowing you to dig deeper in specific areas to discover root causes.

Finding the “why”

KPIs are essential for showing you WHAT is happening—whether that’s positive or negative.

And they can, to an extent, reveal the WHY behind your performance as you go deeper and deeper.

However, after a certain point, you hit a floor. The numbers don’t explain themselves, and you have to go back to physical reality to really understand why things are the way they are.

This is where qualitative data becomes just as critical as quantitative data. It’s why call intelligence tools like Gong have become so business-critical.

Practical example:

You're seeing a drop in qualified opportunities created by your BDR team.

Using your KPI tree, you drill down and identify that the gap is due to a drop in your meeting attended to qualified opportunity rate.

You further identify that the gap is almost entirely due to the performance of a new BDR that recently joined the team, and that their opportunities are being rejected by AEs at a much higher rate.

The KPIs helped you triangulate the gap with a high level of precision—but they can't offer more insight into the critical question:

Why does this BDR have such a high reject rate?

You use qualitative data to answer that question.

By listening to that BDR's calls, you identify that they need to improve their discovery skills and are doing a poor job recording information from the call for the sales team. As a result, the opportunities don't appear qualified, and sales is disproportionately rejecting them.

Armed with this information, you can work with the rep's manager and your enablement team on a performance improvement plan. Besides calls, Jen also suggests several other qualitative methods you can use to better understand gaps you’ve identified or to proactively discovery new ones. These include:

Ride-alongs with GTM team members

Competitive analysis / secret shopping

Customer experience mapping

Conclusion

The ability to prioritize well and communicate your plan can ultimately make or break you as an operator—especially if you’re leading a team.

It’s the difference between feeling overwhelmed-yet-under-appreciated and being seen as a strategic partner, who has a lot of capital built up to say “no” or to drive net new initiatives.

Don’t get me wrong: this type of prioritization is hard.

Not because the analysis itself is particularly difficult.

But because it forces you to

maintain a high level of situational awareness

be rooted in business performance and KPIs

budget time for analysis and planning when you’re already overwhelmed with execution

On the flip side, when you invest that time, you’ll feel a great sense of satisfaction and confidence at the end of a quarter.

You’ll know you did the right work.